With the European football leagues and UEFA scrambling to bring finances under control in the modern era, financial fair play (FFP) has become a thing that no football fan can ignore. These rules are aimed simultaneously at keeping football competitions fair and not just for the pleasure of the richest clubs, while also protecting clubs from overspending and risking collapse. Every week it seems there is a new buzzword to do with FFP. This week we dive into one of the weirdest ones, amortization.

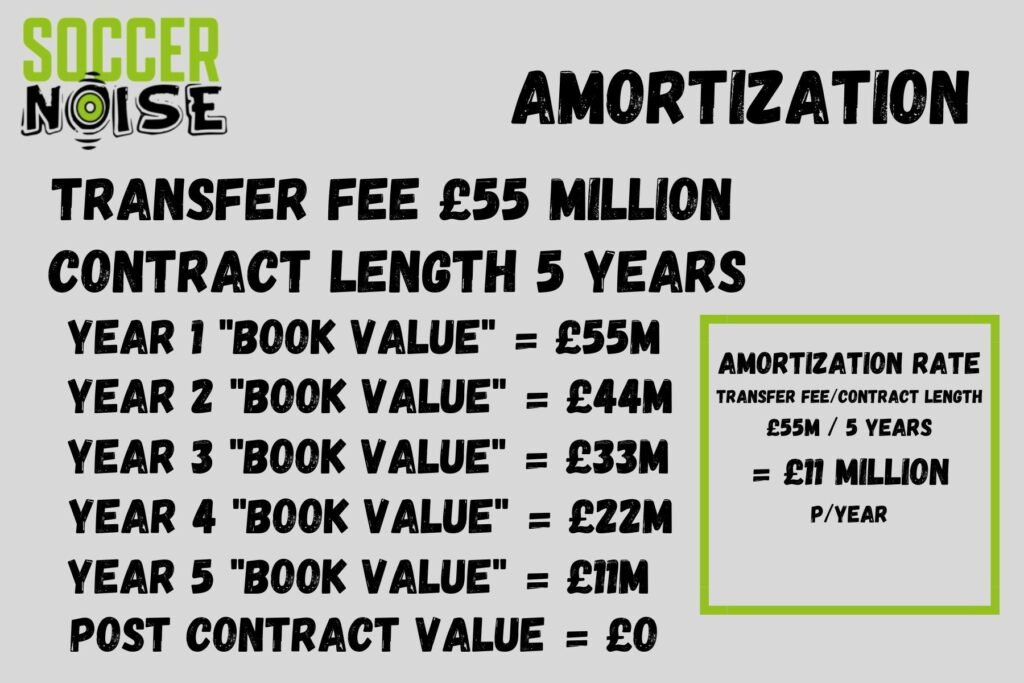

Football FFP: What is amortization? Amortization or “paying down” is a financial accounting practice that refers to assets that depreciate. In the context of football, it is applied to the transfer fee paid for a player when a club buys the rights to their contract. For accounting purposes a player’s contract is seen as an asset. This asset will depreciate as the contract nears its expiry date. If a player is signed for £70 million on a 7 year contract, each year of the contract will see an ‘amortization’ of £10 million (£70m divided by 7 years). This £10 million per year will be seen as a loss in the clubs P&L. By signing players to longer contracts a club can reduce the impact of any transfer fee on the immediate finances of the club.

Hopefully you have caught the gist of how this works. It’s important to note here that this is not part of UEFA, Premier League or any other football governing bodies FFP rules. This is a common accounting practice used by businesses in all sorts of industries and there is nothing overtly shady about it, on the surface.

Do academy players have an amortization value?

Currently any player promoted from a teams academy that signs a full contract with a club does not attract an amortization value. This is because there is no fee paid for the asset that can depreciate. So while the contract of a young talented player with a bright future who has signed a 5 year professional deal with a club does have a real world asset value, there was no cost paid to acquire them, so there is nothing to depreciate in value.

Let’s use Mason Mount as an example. The long time Chelsea academy and first team regular was sold in the summer of 2023 to Manchester Utd for a reported £60 million. For Chelsea’s financial profit and loss (P&L) submissions this was pure profit. They gain a credit of £60 million that will help to offset any past or future spending the club may make when UEFA and the Premier League assess their accounts for FFP compliance.

For Manchester United they have spent £60 million in cash, but gained a £60 million asset in the form of Mason Mounts contract. This expenditure won’t all hit Manchester Utd’s P&L in the same year. Mount has reportedly signed a 5 year contract with a further 1 year player option. So for accounting purposes he is under contract for 6 years. This means that each year Manchester United will see a loss of 1 sixth of his transfer value in their finances as the asset of Mason Mounts contract depreciates. If he is not sold and doesn’t sign an extension eventually the asset will be worth zero as Mount will be free to leave the club on a free transfer.

The longer the players contract the less the hit on the P&L each year, although the total value will remain the same.

It is important to note here that Mounts reported £250,000 a week wages have no impact on his amortization value. This applies only to the money spent to procure his contract. His wages will hit Manchester United’s P&L each year like any other cost.

Could a club assign an asset value to an academy player to add value to their P&L?

Currently this is not possible. In order for an academy player to show up as a profit in a club’s accounts they would have to be sold to another club for a transfer fee. If a player, like Paul Scholes at Manchester United, played out his entire career with one club, then they would not ever be seen as an asset with a value attached for the purposes of the clubs accounting and FFP submissions.

What happens if a club sells a player midway through a contract?

If a player is sold midway through a contract then the value they receive in cash will be added immediately to their profit and loss. With any remaining asset value being taken off as a loss.

If a player had a “book value” remaining of £20 million with 3 years left on their contract and they were sold for £50 million. The club would see a net positive of £30 million added to their P&L.

What happens to a player’s intangible asset value if they sign an extension?

If we take the example from above of a player with a “book value” of £20 million and 3 years remaining on their contract, but instead of them being sold they signed a new contract for 5 years. The old contract would become void. The asset/book value of £20 million would remain. But instead of depreciating at £20m divided by 3 years (£6.7m a year) it would divide over 5 years (£4m a year). The result would be the same, that at the end of the player’s contract the value would be zero as the player could leave on a free transfer.

If that player signed a new contract with the same club after the old one had expired, they would retain their asset value of zero and the club would not see a loss on their P&L as the player’s contract winds down over the coming years.

Do free agents contracts have an amortization rate?

Players signed as free agents, with no transfer fee attached do not have a book value and therefore no amortization rate would apply. The only way a player’s contract would attract the yearly “pay down” as the asset depreciates is if the club paid out money for the rights to it.